Overview of Mandated Services

A consulting service.

Property portfolios for special group, charitable and trusts investments.

We believe that with nearly 30 years of general financial and investment experience and with the specific involvement with, and for a large number of family, select interest groups, special purpose and charitable trusts, we have the capability and skills to offer quality service and direction in most of the necessary areas that are critical to the successful investment administration, management and wealth creation through the property investment asset class.

Our investment process

Guideline equips people and organisations to adopt and implement an appropriate strategic investment policy through a series of workshops that will leave you with the confidence to proceed profitably by the implementation of the following three steps;

- Plan

- Implementation of plan

- Review and overview

These 3 steps are further explained;

Plan

The setting of clearly defined and realistic goals. Following this analysing income and capital, and debt needs must be undertaken prior to the formulating of an appropriate property sector allocation strategy, that groups or trusts can feel best meets their specific needs.

Implementation of Plan

The translation of the sector allocation into mandates and guidelines, to achieve the best possible property investment outcomes.

Management, Review and Overview

Property, financial, tenancy and compliance management form the basis of this part of Guideline’s service. Reviewing, monitoring and reporting is conducted under our normal processes ensures groups or trusts are kept informed and apprised of the success and development of their property portfolio.

Guideline’s relationships and obligations may vary with the needs of our clients.

Our strategies, processes and research sources follow those processes developed and tested over nearly 30 years of providing and managing property investments.

Where investing is done by trustees, the risk management responsibilities of Trustees and the best interests of all investors can be divided into two main functions. Those of setting the asset allocation strategy and managing the investments cannot be delegated and are the direct responsibility of Trustees. Guideline will provide guidance to clients to assist them to fulfil their obligations or needs.

Guideline does not provide investment advice. We will however, guide client groups or trusts through a proven process that facilitates your decision for an appropriate investment strategy that can be followed with confidence.

Investment management, property selection and reporting are the responsibility of Guideline. Client groups will receive annual financial reports containing the relevant tax obligations.

Guideline will work with your accountants and other advisors or brokers to reduce tax and implement all decisions made under the Mandate will be made with tax minimisation in mind.

Investment Objectives

A successful investment strategy must be based on written objectives that are both meaningful and realistic. The investment objectives should provide a comprehensive framework within which investment decisions are evaluated. These objectives are formulated into a mandate that has to be mutually agreed between Guideline and the investor.

Our approach to specifying investment objectives is to first conduct a thorough review of your overall objectives. Amongst other factors, this would encompass planned disbursements/fees, return requirements, inflation, property sectors, and the setting of an appropriate planning horizon. This analysis allows us to set objectives that seek the highest possible returns consistent with the constraints on risk that investors or Trustees have mandated.

Guideline defines risk in mathematical terms and in other more familiar measures that are meaningful to investors. We thus allow the client to understand what risk they are accepting.

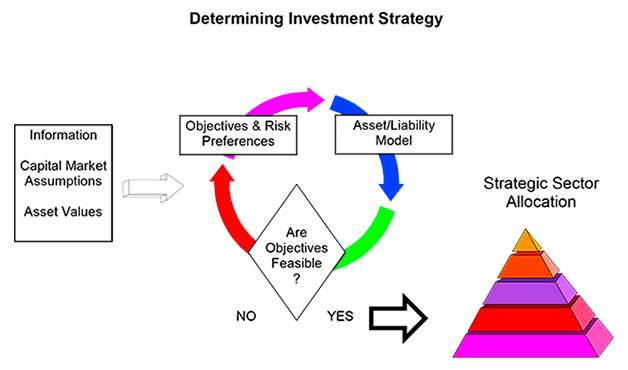

To be useful, objectives must be realistic, and to ensure this, they must be considered in parallel with an overall investment strategy. Examination of possible strategies tells us what objectives are feasible, and choosing one particular set of objectives from those that are feasible defines exactly what strategy should be followed. The process is illustrated in the diagram below.

Further decisions are required to complete the “strategic plan”;

- Equity available to commence

- Further equity contribution levels

- Further debt servicing contribution levels

Investment Strategy/Asset Allocation

Property selection is a strategic decision involving long term decisions. Guideline considers all major property sectors in it’s analysis, including domestic and overseas property and foreign currency exposure, industrial, commercial, retail, residential, rural, infrastructure and development. Our approach is to construct a computer model of assets and liabilities to find the strategic sector allocation that will provide the best possible compromise between the return required to meet the fund’s objectives over the long term and the risk of financial shortfalls.

Guideline has a successful background of applying this and other strategic allocation techniques. Our research and experience allow us to produce individually tailored property investment solutions to suit varying client requirements.

Property Sector Review and Selection

Assisting with investment review and selection is one of the most significant services Guideline provides to it’s clients. We are continually accessing a comprehensive range of research and data from a wide range of sources and conducting research or assessments or our own.

Guideline periodically provides an analysis of this data that is customised for the client given the client’s objectives and strategies.

Our Management and Investment Mandates

Detailed and specific mandates, for clients of sufficient size, have to be written for the benefit of both the client and Guideline. In other

cases, existing mandates are matched as closely as practically to a client’s needs and would cover some or all of thesematters:

- The required return objective

- Permissible sectors

- Taxation considerations

- Benchmarks for performance evaluation

- Diversification and exposure limits within and across each sector

- Reporting standards

Implementation

Upon finalisation and sign off of the “strategic plan” and Mandate Guideline will:

a) Establish the entity

b) Open an interest bearing secure bank account

c) Deposit initial equity

d) Establish process for further equity, or debt contributions

We are now ready to proceed to source and implement the “strategic plan”.

Monitoring and Analysing Results

Monitoring investment results is critical to the successful implementation of an investment program. Our analysis evaluates performance of the individual properties and allows attribution of performance to factors such as market timing and security selection.